Less Manual Copying and Pasting. More Financial Clarity

AUTOMAIT connects your tools and automates tasks, so your team can focus on what matters.

ACCOUNTING

Why Every Business Needs Accounting Automation—And How It Can Transform Your Finance Operations

Imagine this:

Your finance team is juggling invoices, expense reports, payroll, reconciliations, and tax filings—while also trying to deliver accurate forecasts and strategic insights. Traditional accounting systems handle the basics, but they fall short when it comes to eliminating manual data entry, ensuring compliance in real-time, or connecting workflows across multiple departments.

That’s where AI-powered accounting automation steps in.

AI fills the gaps—handling repetitive, error-prone, or cross-system tasks—so your finance team can focus on higher-value work like strategic planning and growth.

Here’s how AI transforms accounting across four essential stages.

1. Capture & Record

Manual data entry slows down AP, AR, and expense management. AI extracts, validates, and classifies financial data in real-time, ensuring accuracy and freeing accountants from repetitive keystrokes.

Workflows Examples:

Invoice Capture & Categorization

Email Trigger → AI Node (extract invoice data) → ERP Node (create AP entry) → Slack Node (notify approver)Expense Receipt Logging

Mobile Upload Trigger → AI Node (OCR + categorize expense) → Accounting System Node (create record)Customer Payment Recording

Bank API Trigger → AI Node (match payment to invoice) → CRM Node (update status)

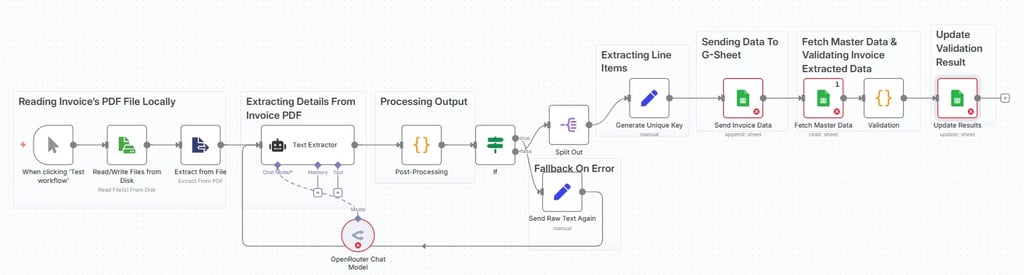

AI-Powered Invoice Processing Workflow

• READ INVOICE PDF → OCR EXTRACTS TEXT → AI AGENT CLEANS INTO JSON → STRUCTURE & REFINE JSON → SPLIT INTO LINE ITEMS → GENERATE UNIQUE KEYS → UPDATE GOOGLE SHEET → FETCH MASTER ITEM DATA → VALIDATE NAME & COST → MARK ITEMS AS VALID OR INVALID.

2. Process & Reconcile

Why:

Traditional systems don’t handle matching, approvals, or reconciliations efficiently. AI automates 3-way matching, flags anomalies, and reconciles accounts instantly, closing the gaps left by manual oversight.

Workflow Examples

3-Way Invoice Matching

AP Entry Trigger → AI Node (validate PO, goods received, invoice) → ERP Node (approve for payment)Bank Reconciliation Automation

Bank Feed Trigger → AI Node (auto-match transactions) → ERP Node (update ledger) → Slack Node (notify of exceptions)Policy Compliance Check

Expense Submission Trigger → AI Node (flag non-compliant expense) → HR/ERP Node (route for review)

3. Report & Comply

Why:

Generating financial statements and ensuring compliance is often reactive and manual. AI provides proactive, real-time insights and creates audit-ready documentation automatically.

Workflow Examples

Real-Time Financial Reporting

Schedule Trigger → ERP Node (aggregate data) → AI Node (generate summary & insights) → BI Tool Node (update dashboard)Tax Filing Preparation

Transaction Trigger → AI Node (categorize tax obligations) → Government e-Filing Node (prepare report)Audit Trail Automation

Transaction Created → AI Node (generate metadata + controls check) → Cloud Storage Node (log immutable record)

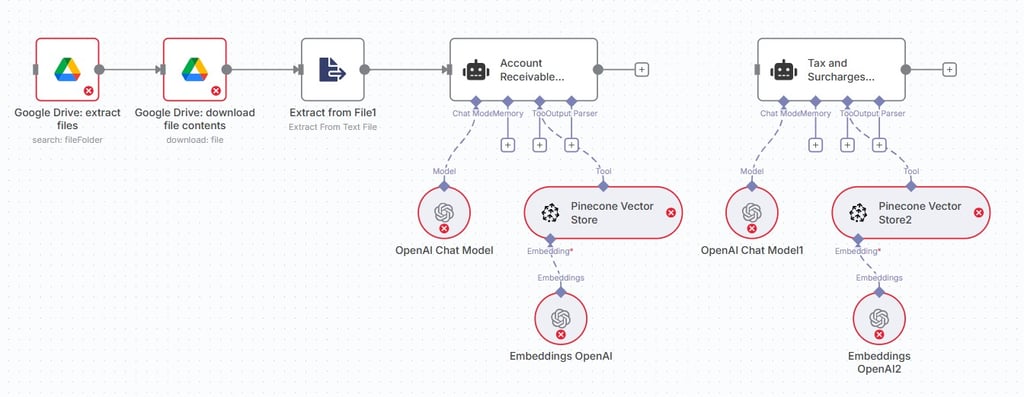

Automated EDI File Parsing & Reporting Workflow

• VECTORIZE SABRE IUR DOCUMENT (154 PAGES) VIA GOOGLE DRIVE + LOADER + SPLITTER → OPENAI EMBEDDINGS → STORE IN PINECONE FOR RAG REFERENCE → TRIGGER FINDS & DOWNLOADS NEW EDI/TXT FILES FROM GOOGLE DRIVE → EXTRACT RAW TEXT → AI AGENTS (WITH GPT-4 + PINECONE) GENERATE STRUCTURED REPORTS INCLUDING ACCOUNTS RECEIVABLE AND TAX/SURCHARGES → OUTPUT FORMATTED FOR GOOGLE SHEETS OR CSV/JSON, WITH EXTENSIONS POSSIBLE FOR AP, REVENUE, SALES, COMMISSIONS, AND PROFIT MARGIN.

4. Forecast & Optimize

Why:

Accounting systems show the past, but they don’t predict the future. AI-driven forecasting and optimization give finance leaders visibility into risks, opportunities, and growth paths.

Workflow Examples

Cash Flow Forecasting

ERP Data Trigger → AI Node (predict future inflows/outflows) → BI Dashboard Node (visualize projection)Budget vs. Actual Alerts

ERP Trigger → AI Node (compare actual vs. budget) → Slack Node (send variance alert)Scenario Planning

Manual Trigger → AI Node (generate multiple financial models) → Excel/BI Node (present scenarios)